Investment Strategy

Proven dynamic strategy to deliver cash yield and capital gains

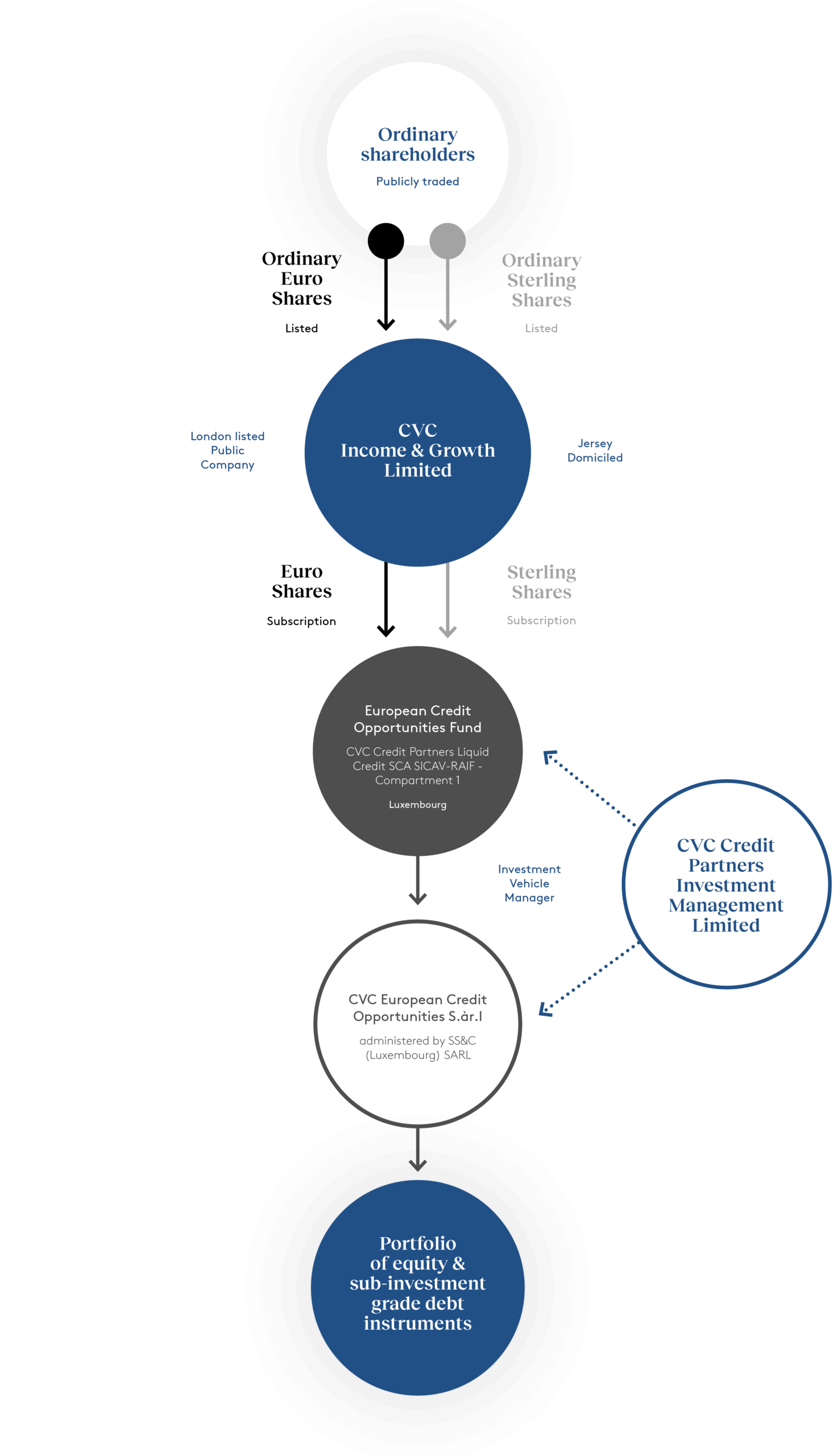

CVC Income & Growth Limited (the “Company”) is an LSE listed, closed-ended investment company, limited by shares, which aims to provide investors with regular income returns and capital appreciation through a diversified portfolio of predominantly senior secured loans and other sub-investment grade corporate credit investments.

The appointed investment manager for the Company is the credit investment platform of the CVC group.

The Company pursues its investment policy by investing all of its assets, save for a working capital balance, in CVC Credit Partners Liquid Credit SCA SICAV-RAIF – Compartment 1 – European Credit Opportunities Fund (the “Investment Vehicle”).

The Company has given effect to its investment policy by subscribing for shares in the Investment Vehicle.

The Investment Vehicle Manager invests in the debt of larger companies and invests in companies with a minimum EBITDA of €50 million or currency equivalent at the time of investment. The Investment Vehicle Manager believes that the debt of larger companies offers a number of differentiating characteristics relative to the broader market:

- larger, more defensive market positions;

- access to broader management talent;

- multinational operations which may reduce individual customer, sector or geographic risk and provide diverse cash flow;

- levers such as working capital and capital expenditure which can be managed in the event of a slowdown in economic growth; and

- wider access to both debt and equity capital markets.

Based on the market opportunity, the Investment Vehicle Manager invests in a range of different credit instruments across the capital structure of target companies (including, but not limited to, senior secured, second lien and mezzanine loans and senior secured, unsecured and subordinated bonds).

Assets are sourced in both the new issue and secondary markets, using the sourcing networks of the Investment Vehicle Manager and in certain circumstances the CVC Group more broadly. The Investment Vehicle Manager’s access to deals is supported by the network of contacts and relationships of its leadership team and investment professionals, as well as the strong positioning of the CVC Group in the European leveraged finance markets. CVC Capital Portfolio Companies are one of the largest sponsor led issuers of leveraged loan deals in Europe.

Each investment considered by the Investment Vehicle Manager is built around an investment thesis and generally falls into one of two categories:

Performing Credit

Performing credit opportunities with an emphasis on cash income. This typically involves investments in senior secured loans and bonds sourced from the primary market, with higher liquidity and lower volatility that offer relative value opportunities.

Credit Opportunities

Timely credit opportunities across the capital structure with a focus on capital gain as well as cash income. The opportunities will often be stressed and diversified investments and/or non-performing, but with the clear potential for some form of recovery and capital gains over time.

The Investment Vehicle Manager analyses the risk of credit loss for each investment on the basis it will be held to maturity but takes an active approach to the sale of investments once the investment thesis has been realised.

An investment in CVC Income & Growth Limited (the Company) is not appropriate for all investors and is not intended to be a complete investment programme. The Company is designed as a long-term investment and not as a trading vehicle. Investing in the Company involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or even all of your investment. Therefore, before investing you should carefully consider the risks that you assume when you invest in the Company’s shares. Investors should consider the Company’s investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other information about the Company. Please read the prospectus carefully before investing. Click here for further information on the risk factors regarding an investment in the Company.